Introduction

As 2024 approaches, blockchain technology is expected to continue its rapid development, bringing revolutionary developments that will influence the digital world. This piece explores 10 key themes shaping the coming year and beyond as it digs into the revolutionary forces propelling the blockchain ecosystem. These new developments provide insight into the centralized technology’s direction. Come along on a tour through the top blockchain trends in 2024, where we’ll explore how asset tokenization, institutional adoption, Decentralized Finance (DeFi), and the revolutionary combination of blockchain and AI interact. In this investigation, we learn how these developments create new opportunities while changing established financial systems.

Embark on an enriching journey into the realms of cloud technology and IT mastery with IPSpecialist! Unlock unparalleled learning experiences through their top-notch courses, providing comprehensive IT certification training and invaluable resources. Whether you’re starting your IT journey or seeking to master advanced platforms like Microsoft, AWS, Cisco, and beyond, IPSpecialist caters to all proficiency levels. Dive into their diverse range of courses, study guides, and practice exams meticulously designed to enhance your skills. Elevate your career in the dynamic world of IT by exploring the wealth of opportunities IPSpecialist has to offer. Additionally, don’t miss out on their cutting-edge Blockchain courses, empowering you with the knowledge to navigate the transformative landscape of blockchain technology. Take the next step in your professional growth—explore IPSpecialist’s offerings today!

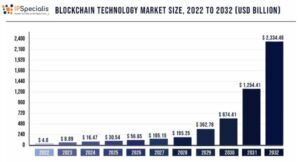

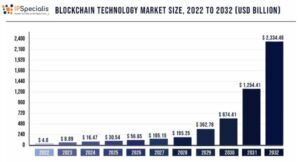

The Blockchain Technology Market: How Is It Expanding?

The projected growth of the worldwide blockchain technology market is substantial, with an estimated size of USD 4.8 billion in 2022. The market is anticipated to experience remarkable expansion, reaching over USD 2,334.46 billion by 2032. This impressive growth trajectory is forecasted to occur at a compound annual growth rate (CAGR) of 85.7% over the period from 2023 to 2032. The statistics highlight the increasing significance and adoption of blockchain technology across various industries, indicating its potential to transform business processes and drive substantial market value in the coming years.

As blockchain technology continues to be the most widely used in the financial services sector (FSI), we suggest taking a look at some of its most prevalent applications. The blockchain is the foundation for most digital currency launches by financial institutions, but the technology is also used for digital identity and safe data exchange.

Trend #1: Blockchain Advancement through Enterprise Adoption:

The growing adoption of blockchain technology within enterprises represents a transformative shift in the digital operations of businesses. This evolution is evident in significant developments, such as introducing BlackRock’s Bitcoin spot exchange-traded fund (ETF) and establishing EDX Markets, supported by critical financial entities. These noteworthy initiatives underscore institutional players’ increasing interest and involvement in blockchain. Beyond mere technological advancements, these trends enhance market stability and democratize access to cryptocurrency investments. The emergence of such initiatives positions blockchain not only as a groundbreaking technology but also as a mainstream instrument within traditional finance, marking a substantial integration of digital assets into established financial frameworks.

Trend #2: Wall Street’s Embrace of Asset Tokenization:

Prominent financial institutions, including JPMorgan Chase, Goldman Sachs, and Fidelity, are at the forefront of harnessing the transformative capabilities of blockchain technology, mainly through asset tokenization. This innovative approach involves converting various assets into digital tokens on a blockchain, unlocking new possibilities for efficiency and accessibility. Citigroup analysts are optimistic about the potential of tokenization, forecasting a substantial market growth to reach $10 trillion by 2030. This expansive scope encompasses diverse assets, such as private-sector securities, funds, central bank digital currencies, and stablecoins.

A new and dynamic financial landscape is shaping as Wall Street actively explores and invests in these blockchain-based financial avenues. The pursuit of efficiency gains and cost reductions drives this transformative shift. By leveraging blockchain’s decentralized and secure nature, financial institutions aim to streamline asset management, trading, and settlement processes. Adopting blockchain technology for asset tokenization promises increased transparency, reduced transaction friction, and improved accessibility to a broader range of investors, ultimately reshaping the traditional financial industry and paving the way for a more agile and technologically advanced future.

Trend #3: The Rising Power of Decentralized Finance (DeFi):

The rapid growth of Decentralized Finance (DeFi) is reshaping the financial landscape, giving rise to sectors like GameFi, SocialFi, and InsureTech. Ethereum’s innovative contract capabilities are crucial in this evolution, enabling trustless and automated agreements in decentralized applications (DApps). GameFi introduces economic models where in-game assets hold real-world value, SocialFi transforms social interactions through decentralized platforms, and InsureTech integrates blockchain for transparent insurance processes. The versatility of DeFi technologies, from BusiFi to SocialFi, promises to redefine industries by promoting efficiency, transparency, and innovation. Beyond disrupting traditional financial structures, DeFi creates inclusive financial solutions, influencing diverse sectors and fostering collaboration. DeFi is set to reshape the global financial landscape as it evolves, fostering a more decentralized, accessible, and innovative ecosystem.

Trend #4: Central Bank Digital Currencies (CBDCs) as a Monetary Anchor:

The surge in digital payments has spurred central banks worldwide to explore Central Bank Digital Currencies (CBDCs) as a risk-free digital standard, ensuring monetary sovereignty. The digital euro project exemplifies this trend, highlighting a broader shift towards digital assets for economic stability. CBDCs involve central banks issuing digital currencies, providing a secure alternative to physical cash in response to the growing prevalence of digital payments. The global embrace of CBDC initiatives signifies the pivotal role of digital currencies in shaping future financial systems. Central banks actively engage with the market to align CBDC developments with current dynamics, reflecting a strategic move to embrace technology, enhance inclusivity, and adapt to evolving consumer preferences. This exploration and implementation of CBDCs contribute to the ongoing transformation of the global monetary landscape, paving the way for a more digitized and resilient financial future.

Trend #5: Navigating the New Normal with Increasing Blockchain Regulation:

The cryptocurrency landscape, characterized by its volatility and environmental concerns, has prompted a call for robust regulatory frameworks to address associated risks. Governments are urged to actively craft comprehensive regulations that can stabilize the volatile market and mitigate systemic risks. These regulations aim to balance fostering innovation within the crypto ecosystem and addressing investor protection and environmental impact concerns.

Trend #6: SEC Intensifies Scrutiny on Cryptocurrency Exchanges:

The U.S. Securities and Exchange Commission (SEC) has intensified its scrutiny of cryptocurrency exchanges, taking legal action against prominent platforms such as Binance and Coinbase. Although these actions introduce short-term uncertainty in the crypto market, they also signal a potential shift towards standardized and transparent regulations. The regulatory scrutiny from the SEC could ultimately contribute to long-term stability in the cryptocurrency market by establishing clear guidelines and fostering a more secure environment for investors and participants. This increased oversight may legitimize the industry, assuaging concerns and laying the groundwork for a more regulated and trustworthy cryptocurrency ecosystem.

Trend #7: Technical Drawbacks and User Challenges Limit Blockchain:

While blockchain technology has undeniably revolutionized the financial landscape, it grapples with formidable challenges, including scalability issues, energy consumption concerns, and user-centric complexities. The blockchain trilemma, a fundamental challenge of balancing security, scalability, and decentralization, poses a significant obstacle to its widespread adoption. Tackling these technical inefficiencies and enhancing user experiences is imperative for blockchain technology’s broader acceptance and integration. Efforts to address these challenges ensure the continued evolution of blockchain and pave the way for its seamless integration into various industries, unlocking its full potential as a transformative force in the global digital landscape.

Trend #8: An Expanding Definition for ‘The Metaverse’:

Although blockchain technology has unquestionably transformed the financial industry, it faces several difficult obstacles, such as problems with scalability, energy consumption, and user-centric complexity. A major barrier to the broad adoption of blockchain technology is the trilemma, which is essentially the problem of striking a balance between security, scalability, and decentralisation. It’s critical to address these technological shortcomings and improve user experiences if blockchain technology is to be widely adopted and integrated. In order to fully realize blockchain’s promise as a disruptive force in the global digital environment, efforts must be made to remove these obstacles in order to assure the technology’s continuing progress and to facilitate its smooth integration into a variety of businesses.

Trend #9: Guidelines and Future Directions for Implementing Metaverse Technologies:

In the evolving landscape of technology, there is a growing call for governments to institute regulations that govern the responsible implementation of Artificial Intelligence (AI) and ensure the equitable distribution of its benefits. Concurrently, several key trends are shaping the future of Metaverse technologies. These trends include the rise of CeDeFi-based platforms, the emergence of DeFi 2.0, the integration of digital twins (DTs), the development of cloud-assisted Metaverse, advancements in conditional privacy measures, and ongoing progress in background technologies. These transformative trends collectively indicate a dynamic shift in the technological realm, focusing on enhancing the functionality, accessibility, and ethical considerations surrounding AI and Metaverse technologies.

Trend #10: AI-Enabled Blockchain:

The intersection of Artificial Intelligence (AI) and blockchain is causing substantial disruptions across industries, particularly in the realms of robotics and industrial automation. Although these technologies’ amalgamation presents theoretical and practical challenges, businesses are actively forging comprehensive frameworks to facilitate the seamless implementation of AI-enabled blockchain systems. The overarching goal is to enhance operational efficiency, foster transparency, and stimulate innovation within these sectors. As organizations navigate the complexities of this convergence, the potential benefits promise to redefine the landscape of robotics and industrial automation, offering transformative solutions that optimize processes and drive technological advancement.

Conclusion:

In the fast-evolving landscape of blockchain technology, 2024 promises to be a pivotal period marked by transformative trends. From the growing enterprise adoption of blockchain to the prominence of asset tokenization and the rising influence of decentralized finance (DeFi), these trends underscore the dynamic nature of the blockchain ecosystem. Institutional players are increasingly engaging with blockchain, as seen with the introduction of BlackRock’s Bitcoin spot ETF and the establishment of EDX Markets, reflecting a broader integration of digital assets into traditional finance. Asset tokenization led by major financial institutions like JPMorgan Chase and Goldman Sachs is reshaping Wall Street, aiming for efficiency gains and cost reductions. Simultaneously, the decentralized finance sector, spanning GameFi, SocialFi, and InsureTech, driven by Ethereum’s smart contracts, is redefining financial structures and fostering inclusive solutions.

FAQs:

-

How are institutional players influencing the blockchain landscape in 2024?

Answer:

Institutional players are increasingly engaging with blockchain, as seen with the introduction of BlackRock’s Bitcoin spot ETF and the establishment of EDX Markets. These initiatives highlight the integration of digital assets into traditional finance, contributing to market stability and democratizing access to cryptocurrency investments.

-

What role does asset tokenization play in the transformative trends on Wall Street?

Answer:

Prominent financial institutions like JPMorgan Chase, Goldman Sachs, and Fidelity are leading the way in asset tokenization. This involves converting various assets into digital tokens on a blockchain, unlocking new possibilities for efficiency, accessibility, and transparency in asset management, trading, and settlement.

-

How is the rising power of decentralized finance (DeFi) reshaping the financial landscape?

Answer:

DeFi is revolutionizing finance by introducing sectors like GameFi, SocialFi, and InsureTech. Enabled by Ethereum’s smart contracts, DeFi technologies offer trustless and automated agreements, transforming industries and promoting efficiency, transparency, and innovation. DeFi goes beyond disrupting traditional financial structures, creating inclusive financial solutions, and influencing diverse sectors for a more decentralized and innovative ecosystem.